portability estate tax exemption

Portabilitys Effect on Tax-Efficient Estate Tax Planning. But for the need to make the portability election the estate would not be required to file an estate tax return Revenue Procedure 2017-34 PDF provides a simplified method for certain taxpayers to obtain an extension of time to make the portability election under 2010c5A of the Internal Revenue Code.

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Electing to use estate tax portability makes a significant difference in your federal estate tax liability.

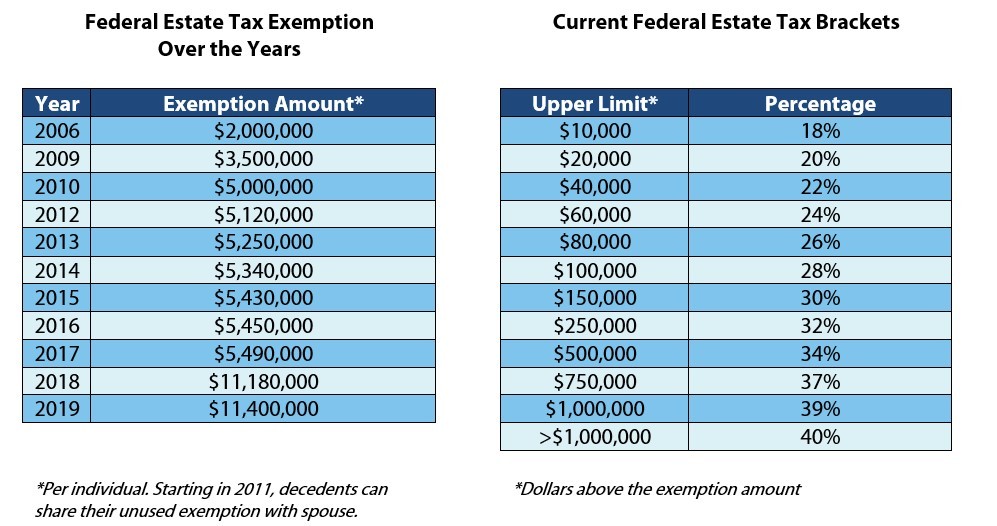

. The Tax Cuts and Jobs Act increased the federal estate tax exemption in 2018 and it has increased since then adjusting with inflation so its no surprise that the exemption is higher for 2022. Currently the federal estate tax exemption is 11400000 per spouse. The exemption is in fact indexed annually for inflation so it does increase over time.

New Yorks estate tax exemption. The estate and gift tax exemption was 1 million in 2002. After 2012 one important question for estate planning is whether or not portability should be elected at the first death.

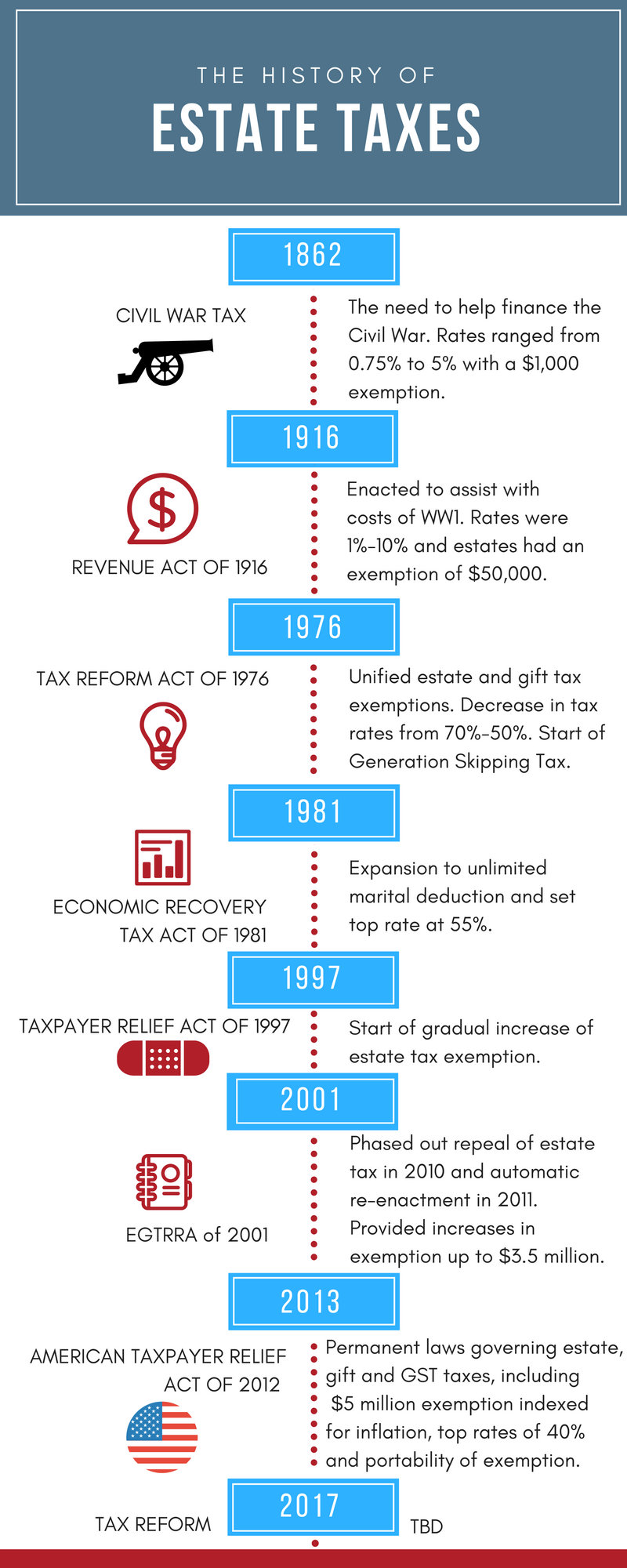

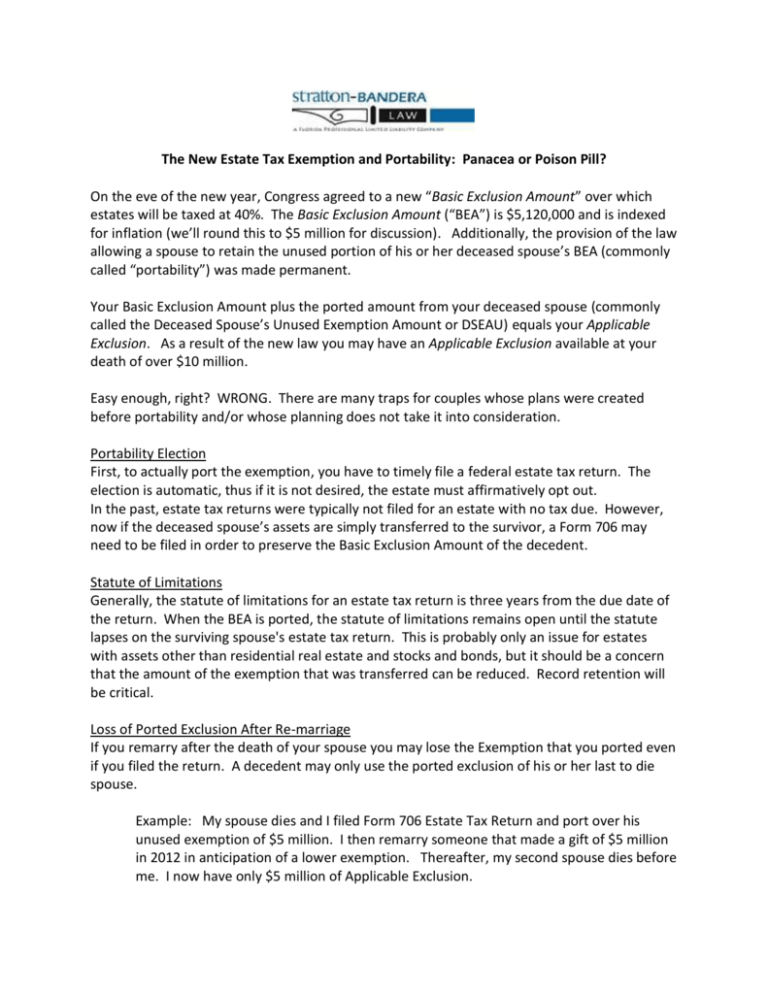

The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death. The American Taxpayer Relief Act of 2012 ATRA made permanent the portability of estate tax exemption between spouses. When the surviving spouse later dies or makes a lifetime gift the surviving spouse will have his or her own.

That number was indexed for inflation and went up each year. As a result you could face exposure to the state estate tax even if you are exempt from the federal tax. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706.

Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for Illinois. This post will discuss the general rules of portability. A surviving spouses tax return will be largely dependent on the portability of the exemption.

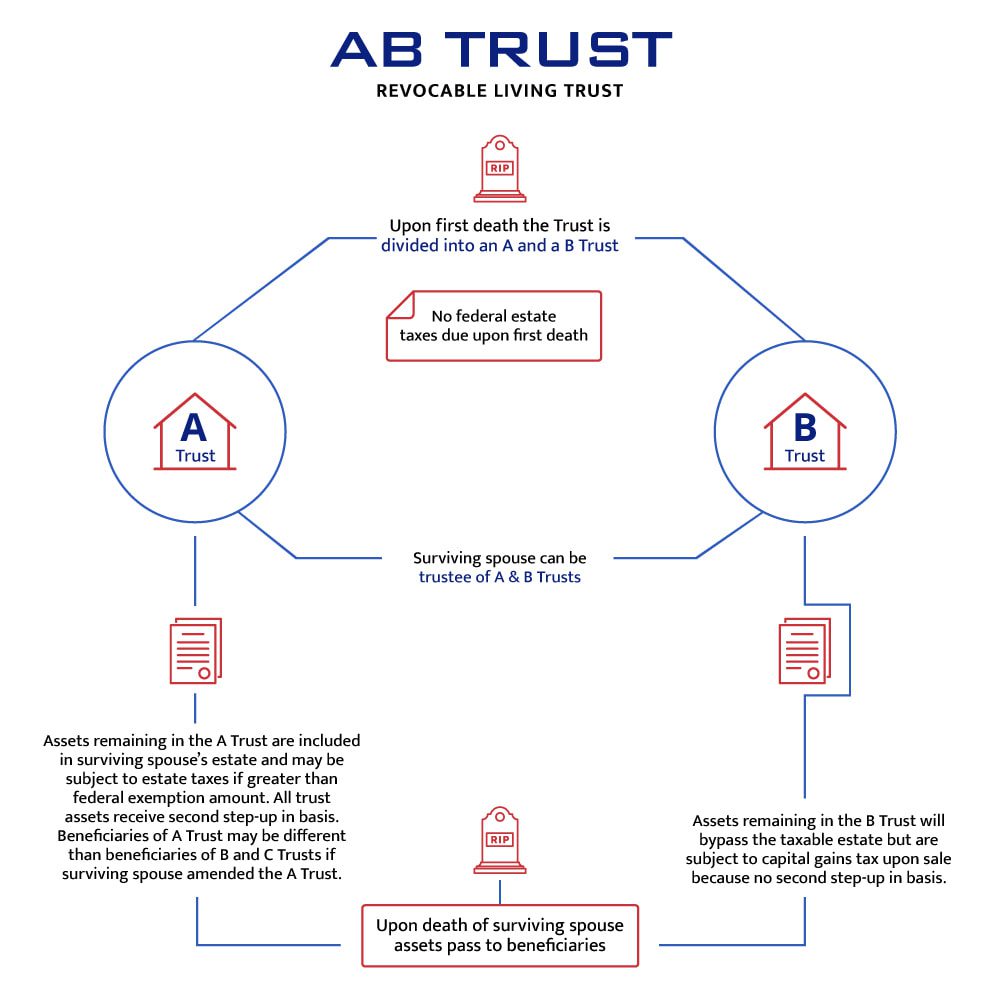

The term portability refers to a legal term used to refer to the ability to transfer an estate tax exemption to a surviving spouse. The need for splitting the estate into. It can be used in any of the four ways listed above.

On the state level the exclusion is considerably lower than the federal exclusion at just 549 million. Estate tax pursuant to the applicable treaty. The non-exempted amount of 545 million would be portable and would be passed to his wife.

Some states that have estate taxes do not allow for portability between spouses. The exemption is subtracted from the value of estate assets with the result being subject to the estate tax. This was just the estate tax portability rules though.

For decedents dying in 2011 and 2012 the personal representative can elect to transfer the deceased spouses unused exemption to his or her surviving spouse. Prior to the enactment of the portability law in 2010 most estate plans for married couples set aside at the first. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the.

As of that time the estate tax exemption was much lower. The Illinois estate tax on an estate of 16880000 would be 1524400. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly.

Fortunately we are on the right side of this. Depending on the date of the deaths the total exemption amount may exceed 24 million. Attach a statement to the return that refers to the particular treaty applicable to the estate and write that the estate is claiming its benefits.

The state does however provide an estate tax cliff up to 105 of the exemptable amount. With the passage of the Tax Cuts and Jobs Act of 2017 its 1206 million per person for deaths in 2022. In order to benefit from this exemption however the surviving spouse must file IRS Form 706 the United States Estate and Generation-Skipping Transfer tax return within nine months of the first death in order to elect portability.

However that exemption is scheduled to return to 5000000 as adjusted for inflation in 2026. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their wishes. The federal estate tax exemption and gift exemption is presently 1206 million.

It is twice the amount for married couples. If the portability election is filed in time the entire estate of 60 million will be named under the wife. And then after one spouses death then the surviving spouse can take steps to combine their estate tax exemptions to reduce estate tax.

In reality very few estates will pay estate tax. Assets are exempt from US. Each year the government sets a tax exemption limit or exclusion amount for estates under a.

Portability also applies to gift tax and therefore the gift tax exemption is also 16880000 for the survivor. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within 270 days after her husbands death. Please note these laws being permanent means that they are not set.

If during hisher lifetime the survivor. Kate is the widow of Henry and is soon to be married to John. The estate and gift tax exemption is the amount you can transfer to individuals other than your spouse free of estate and gift taxes during your lifetime or at your death Generally speaking you can transfer as much as you want to your spouse without incurring estate and gift taxes.

Please note that these exemption amounts are for individuals. The key advantage of portability is flexibility. After all electing portability could mean that a surviving spouse could have double the estate tax exemption at the second death currently 5430000 x 2 10860000.

A married couple can transfer 2412 million to their children or. If the filing threshold has not been met in other words. What this means is that for an estate exceeding the threshold by.

With exemption levels being indexed for inflation the exemption amount has gone up still. A surviving spouses taxable estate may be greater than his or. Regarding the estate tax exemption for couples.

Entries for the gross estate in the US the taxable estate and the tax amounts should be 0 if all of the decedents US. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million for 2021. Portability became available in 2011 when the exempt amount was 5 million.

Furthermore if the second spouse had any DSUE amount to transfer the surviving spouse can now only inherit that amount. As of 2021 the federal estate tax exemption is 114 million. Under portability if the first spouse to die does not use his or her exemption from estate and gift tax the executor of the first spouses estate may elect to give the use of the remaining exemption amount to the surviving spouse the so-called deceased.

A Brief History Of Estate Gift Taxes

Pin On Real Estate Information For Buyers And Sellers

Your Estate Plan Don T Forget About Income Tax Planning Kirsch Kohn Bridge Cpas Advisors

Historical Estate Tax Exemption Amounts And Tax Rates 2022

To A B Or Not To A B That Is The Question Botti Morison

Estate Planning Can Secure Your Legacy Jackson Fox Pc Ardmore Ok

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Form 706 Extension For Portability Under Rev Proc 2017 34

Estate Planning Technique Grantor Retained Annuity Trusts C W O Conner Wealth Advisors Inc Atlanta Georgia

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Exploring The Estate Tax Part 2 Journal Of Accountancy

The New Estate Tax Exemption And Portability Panacea Or Poison

Portability Of A Spouse S Unused Exemption 1919ic

Exemption And Marital Deduction Planning Wealth Strategist Designs

To A B Or Not To A B That Is The Question Botti Morison

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Credit Shelter Trusts And Portability Eagle Claw Capital Management